What is invoicing system in Japan?

In order to deduct the consumption tax you paid on deductible (taxable) purchases from the consumption tax you charged your customers, you require the ‘qualified invoices’ issued by ‘qualified taxable persons (qualified businesses)’. And you will need to submit a form to a tax office to become a qualified business. Also, a qualified business must be a taxable person. This new rule will start in October 2023.

Some non-taxable persons should become taxable persons

If you are a non-taxable person (What is taxable person? See this page), you don’t need to file a consumption tax return and make the consumption tax payment. But you can still charge your customers consumption tax, normally. Therefore, for the non-taxable persons, the consumption tax is simply (part of) the revenue. However, in 2023, above new tax rule will be introduced, and you may have to become a taxable person. Why? Taxable persons want to deduct consumption tax from the consumption tax they charge their customers. So they would purchase products or services from taxable persons rather than non-taxable persons.

What should non-taxable persons do?

If you (non-taxable person) have many business-to-business (B2B) transactions, “probably” you should become a taxable person in October 2023 so that you can issue a qualified invoice, and then taxable persons who purchase your products or services are able to deduct the consumption tax. But if you are sure that the businesses that purchase your products or services are non-taxable persons, it may not be necessary. On the other hand, if you have many business-to-consumer (B2C) transactions (e.g. retail), “probably” you don’t necessarily have to become a taxable person because most consumers do not seem to be taxable persons. But, you never know that. If you think many of your consumers are actually taxable persons, maybe you should become a taxable person as well. So it really depends.

If you want to check your situation (roughly), you can download our spreadsheet. It is free.

Deductible invoice will become non-deductible gradually

An invoice issued by a non-taxable person cannot be used for deducting the consumption tax gradually. Only eighty percent of the invoice amount can be deductible between 1st October 2023 and 30th September 2026, and fifty percent can be deductible between 1st October 2026 and 30th September 2029. And nothing is deductible after that.

Some updates

20% rule (2割特例/Niwaritokurei)

This new invoicing rule will have a significant impact on small businesses. They are not required to file a consumption tax return because of their annual sales (if their annual sales are JPY 10 million or less constantly, they are normally not required to file a consumption tax return). However, due to the new invoicing rule, some of them need to file it after October 2023. This is additional cost. Given that, there will be a new rule for them. If they (non-taxable person) become a taxable person (qualified taxable person), their consumption tax payment can be “20% of their annual sales”. Here is an example.

Annual sales: JPY 6,600,000

Consumption tax payment ‘without’ 20% rule above: JPY 600,000

Consumption tax payment ‘with’ 20% rule above: JPY 120,000 (JPY 600,000×20%)

(If there are some expenses that include a consumption tax, they can reduce a consumption tax payment when the 20% rule is not applied. But any expense is not considered here to make it simple. Thus you may need detailed consultation when you make any decision.)

As you see, this will reduce a consumption tax payment. This 20% rule will be available from October 2023 to September 2026.

Due date of the invoicing system registration extended in practice

Initially, if you want to become a qualified taxable person from 1st October 2023, you are required to submit some documents to your tax office by 31st March 2023. However, this due date is extended. Now you are able to submit them by 30th September 2023 (if you want to become a qualified taxable person from 1st October 2023.) You have more time to consider. By the way, when do you need to submit them if you want to register after the extended due date? You will need to submit them around 15 days prior to the date you need the registration.

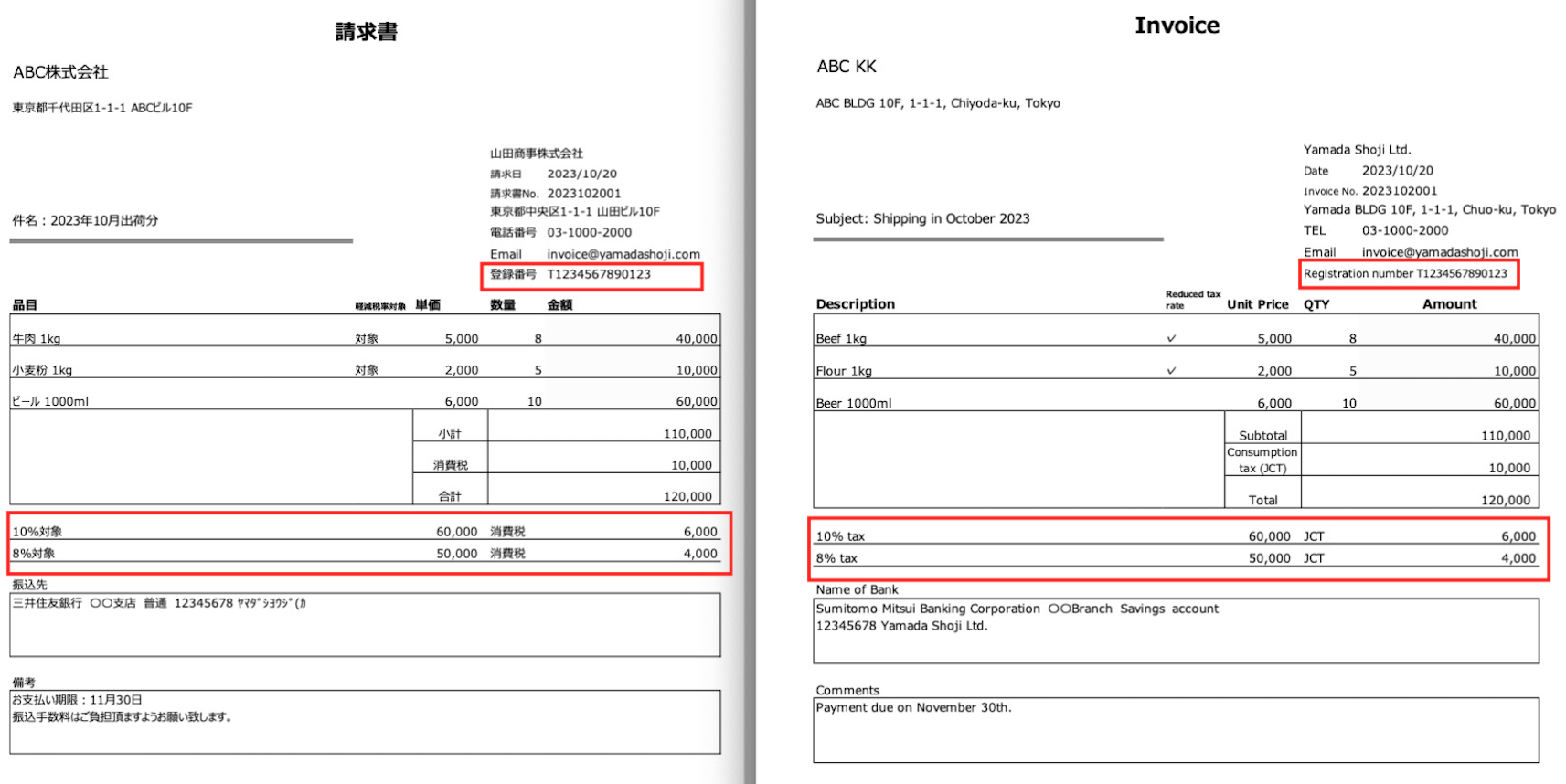

Need to add some additional info to your qualified invoice

In addition to general information on your invoice (e.g. date, amount, description), you will need to add some additional information to your qualified invoice.

You will need to add “registration number”, “Amount per tax rates (10% or 8%)”, and “Amount of consumption tax per tax rates (10% or 8%)”

You can download the invoice template here.

It is recommended you also check the expense documentation.

Note

As per the invoicing system, there are many changes you may (or may not) need to know. Thus it is not possible to explain all of them here. If you have any questions or concerns, we recommend you ask any tax professional.

(Update: 2023/8/30)