Information on accounting

Accounting is important. It could be hard to understand it though. Accounting can help you understand the financial position of your business and also tells you what was good, what was not good, and what is going to be needed for success in the future. Regardless of whether you like it or not, accounting is mandatory so you or your employees (or an accountant) have to record all financial transactions relating to your business and prepare financial documents such as balance sheet and income statement (these are also required for a corporation income tax return). Even if your accountant covers everything relating to accounting, we still recommend you learn accounting to achieve your goals.

Accounting tips

- Double-entry bookkeeping is required: What is double-entry? One transaction needs two entries. When you sold a product, cash increases and sales increase, for example. See the below.

-

Debit (Dr) account Amount Credit (Cr) account Amount Cash 1,000 Sales 1,000 - We don’t explain Debit and Credit here as it may be complicated. You can simply record Cash on the left side (Debit) and Sales on the right side (Credit). This is basically the universal rule.

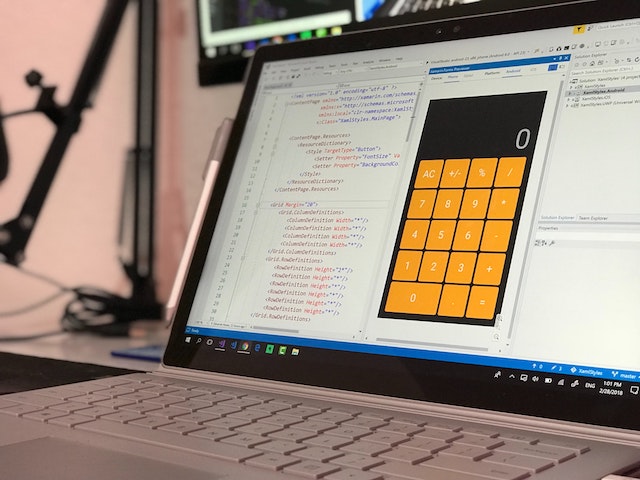

- Use accounting software: This is definitely essential if you record transactions by yourself. Accounting software does many things for you, and one of them is double-entry bookkeeping so you may not need accurate understanding of it. And to avoid any errors, this is helpful. By the way, accounting software widely used in Japan is Yayoi Kaikei (this is only available in Japanese). Or you can use accounting software in your country but some functions that Japan tax rule needs may be missing.

- Not cash basis of accounting: Actually, the above sales entry rarely happens because cash is received after sales are recognized. Thus sales are recorded usually when you issue an invoice to your customer. See the below.

-

Debit (Dr) account Amount Credit (Cr) account Amount Issue an invoice Accounts receivable* 1,000 Sales 1,000 Cash received Cash 1,000 Accounts receivable* 1,000 - *Accounts receivable means a record that sales are not yet paid (on the left side: Debit) and cash is received (on the right side: Credit).

Basic journal entry examples you can use

Note: There are possibly several ways of recording transactions. We basically show the most common one here.

Purchase and sales

When you buy goods

| Dr | Amount | Cr | Amount |

| Purchases | 500 | Accounts payable | 500 |

When you pay the invoice

| Dr | Amount | Cr | Amount |

| Accounts payable | 500 | Cash | 500 |

When you issue an invoice to your customer

| Dr | Amount | Cr | Amount |

| Accounts receivable | 1,000 | Sales | 500 |

When you receive cash from your customer

| Dr | Amount | Cr | Amount |

| Cash | 1,000 | Accounts receivable | 1,000 |

When you have goods that you have not yet sold at the end of a particular period (month, quarter, year, etc )

| Dr | Amount | Cr | Amount |

| Inventory | 200 | Purchases | 200 |

Fixed assets

Coming soon.

If interested in our bookkeeping services, visit Bookkeeping services.