(Uploaded: 2025/8/25)

How to Create an Invoice in Japan

Introduction

Creating a sales invoice is one of the most basic tasks in business, not just in Japan.

However, if you create an invoice in Japan using the same method as in your home country, there’s a possibility of problems or it may appear unnatural to Japanese people.

It is better to avoid such issues to gain your customers’ trust. The Consumption Tax Act specifies what must be included on the invoices you create (called qualified invoices).

This article will mainly explain these points and other things to be aware of.

Invoice Items

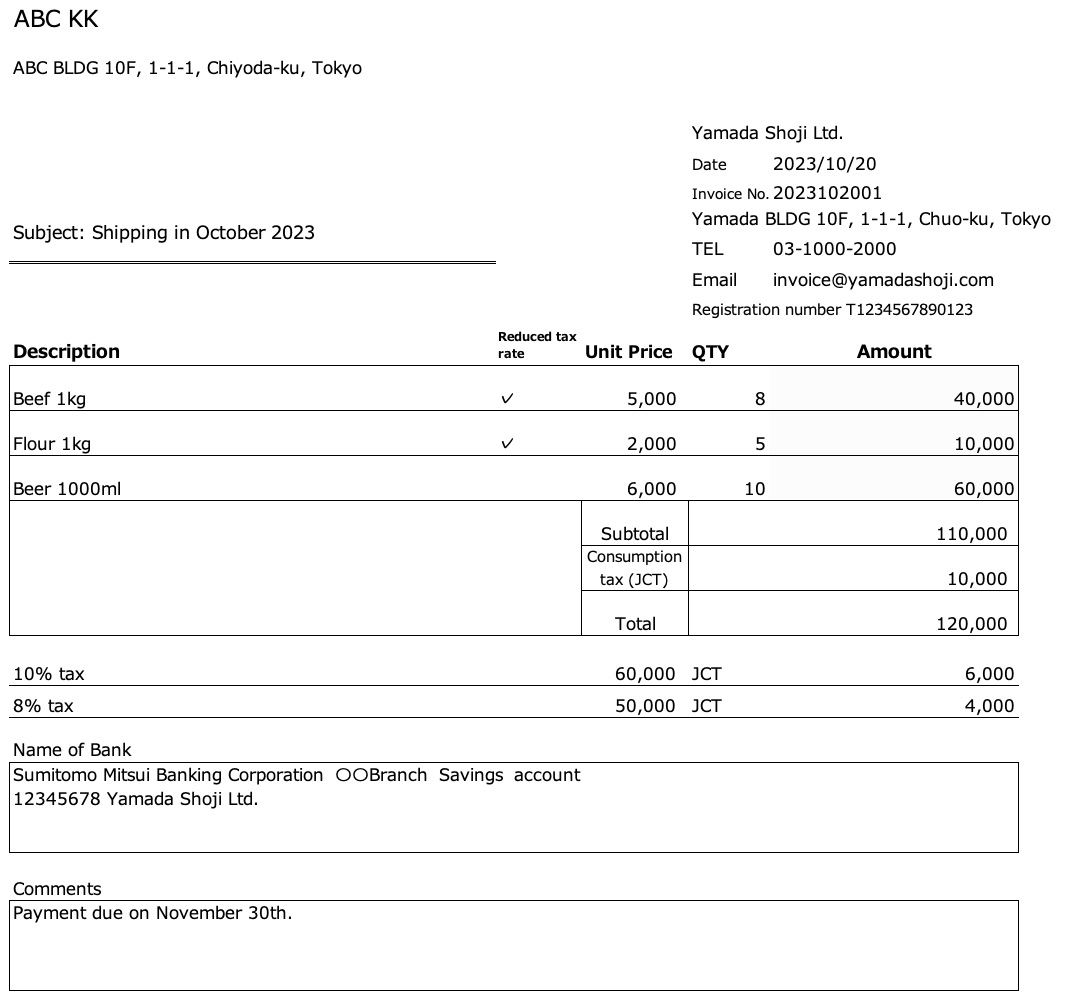

First, please look at the image below to see what items are included. (Click here if you wish to get the image in Excel)

Your Name

You would not create an invoice without your name on it, but it is of course required.

Date of Transaction

You must state when the transaction occurred. In many cases, the date the invoice was issued is stated.

Details of the Transaction

The details of what kind of transaction was made must be clear.

If you sold a product, state the specific name of the product; if you provided a service, state what kind of service it was.

Total Amount for Each Tax Rate

Consumption tax is either 10% or 8% (some transactions are not subject to consumption tax).

You must state the total amount categorized by each tax rate. In the image above, JPY 60,000 is listed for 10% and JPY 40,000 is listed for 8%.

Consumption Tax Amount for Each Tax Rate

You must state the consumption tax amount for each tax rate. In the image above, JPY 6,000 and JPY 4,000 are listed as JCT (Japan Consumption Tax).

Name of the Invoice Recipient

The name of your customer must be listed.

JCT Registration Number

The invoice system started in 2023. Accordingly, if you are registered for it, you must list your registration number.

Note that a registration number is not automatically given, so you will not have one if you have not completed the registration procedure.

Points to Note Regarding Invoices

In addition to the items stipulated by the Consumption Tax Act, there are some things you should remember when creating an invoice.

Do not write amounts of less than JPY 1

In principle, numbers less than one decimal point do not occur in Japan.

Therefore, you should avoid writing amounts such as JPY 10,000.78.

Share the same understanding of consumption tax with your customer

Suppose there is a customer who wants to buy your product for JPY 10,000.

In that case, should you issue the invoice for JPY 10,000? Or should you issue it for JPY 11,000, which includes the 10% consumption tax?

Either is possible. Even at JPY 10,000, it is possible to assume that the consumption tax is already included.

In other words, you and your customer must share a common understanding.

If you say you will sell a product for JPY 10,000 and then issue an invoice for JPY 11,000, it may cause problems.

Confirmation of Withholding Income Tax

If you are a sole proprietor (mainly professionals such as certified accountants, lawyers, photographers, designers, interpreters, etc.), it is not recommended to create an invoice without considering withholding income tax.

The company paying you may be required to deduct withholding income tax from the payment amount. That’s right, this is not your obligation but the company’s obligation (there are also fines).

However, that does not mean you don’t have to do anything. You should also cooperate with the company so that they can properly fulfill their obligation.

The tax rate is 10.21% (if it exceeds JPY 1,000,000, the portion exceeding that amount is 20.42%). If you issue an invoice for JPY 110,000 (JPY 10,000 consumption tax), the withholding income tax is JPY 10,210, and you will receive JPY 99,790.

It would be good if JPY 10,210 is listed on your invoice. Note that this is a prepayment of tax, so it is a tax that will be deducted when your final tax amount is determined in your tax return.

It is possible to write an invoice in a foreign currency

You can create invoices in US dollars or euros. However, there is one point to be aware of.

You need to write the consumption tax amount for each tax rate in the amount converted to JPY.

Summary

I have explained the necessary items and points to be aware of when creating an invoice in Japan.

I have focused on the points related to taxes.

If you do not properly list these, your customer who is making the payment may have trouble.

Therefore, to maintain a trusting relationship, let’s reflect what has been explained in this article in your invoices starting today.

LEAVE A REPLY