What is the Small Business Mutual Aid program in Japan?

(Uploaded on: 2024/5/22)

-

Overview

The Small Business Mutual Aid (Small Business Mutual Fund) program is a mutual aid scheme that allows individual business owners or company executives of small enterprises in Japan to prepare funds in advance for stabilizing their livelihood or rebuilding their business upon retirement or cessation of business. It can be considered a retirement benefits system for business owners. While there are several caveats, the program offers significant tax-saving benefits.

In Japanese, it is called ”小規模企業共済制度”.

-

Benefits

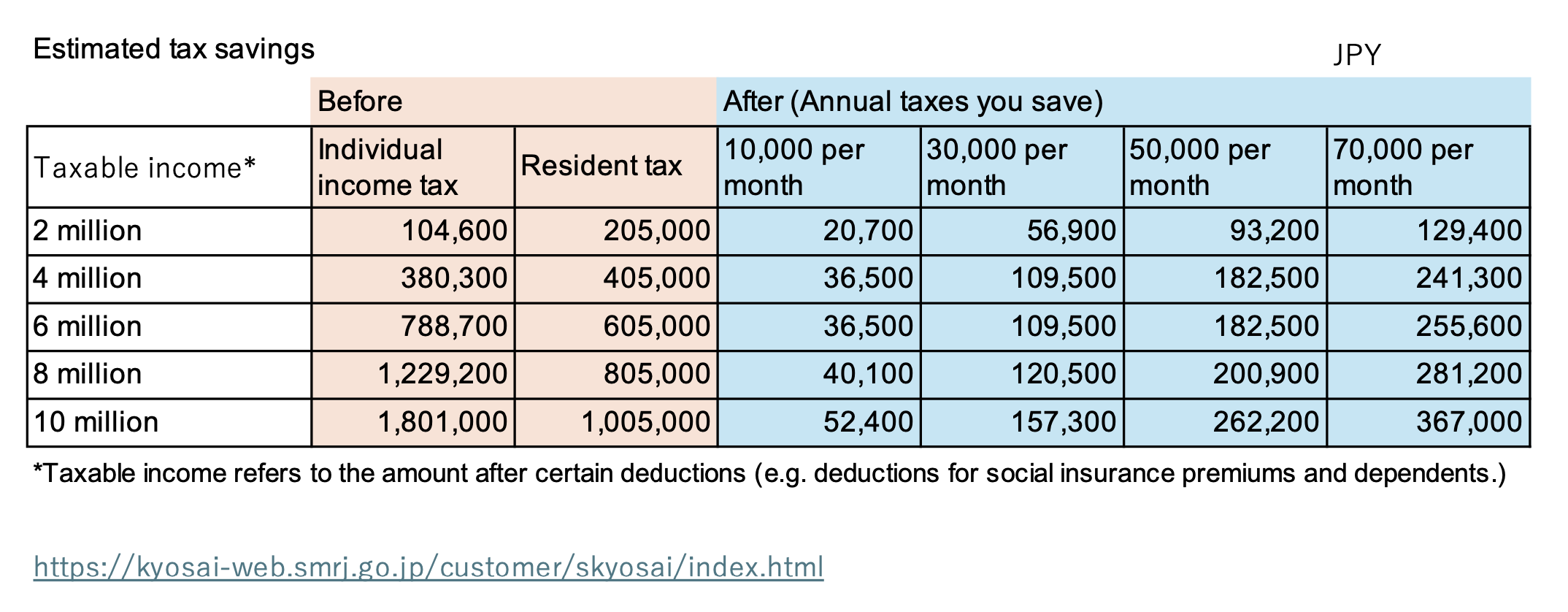

(a) Premium deduction from income: The entire amount of premiums can be deducted from taxable income. See below.

(b) Preferential treatment for receiving mutual aid funds: Mutual aid funds can be received either in a lump sum or in installments. A lump sum is treated as “retirement income,” and installments are treated as “public pensions (miscellaneous income),” both of which come with tax benefits.

(c) Low-interest loans: A loan system is available within the range of (70-90% of) premiums paid, generally at low-interest rates.

-

Disadvantages

(a) Forfeiture with “voluntary” cancellation within 12 months: There is a risk of not receiving a refund (mutual aid funds) if the membership period is less than 12 months.

(b) Loss of principal with “voluntary” cancellation within 20 years: If you voluntarily cancel the membership within 20 years, the refund (mutual aid funds) may be less than the premiums paid.

(c) Taxation on receiving mutual aid funds: Although there are tax benefits, mutual aid funds are still subject to taxation upon receipt.

-

Who is eligible?

Individual business owners and company executives with fewer than 20 employees (fewer than 5 employees for commercial and service industries), for example.

-

Premiums

Premiums can be set from JPY 1,000 to JPY 70,000 per month, with options for increasing or decreasing the amount. Payments can also be made semi-annually or annually.

-

Procedures

Applications for enrollment can be made online or at commercial and industrial associations, chambers of commerce, or financial institutions (In Japanese, Syoukoukai, Syoukoukaigiso or Kinyukikan).

-

Conclusion

The Small Business Mutual Aid program (小規模企業共済制度) is designed for individual business owners and executives in Japan to systematically accumulate retirement funds. While it offers significant tax-saving benefits, there are disadvantages such as the conditions for cancellation. It’s important to effectively utilize this system considering your future life plans. When considering the use of this program, it is crucial to thoroughly assess your business situation and determine the optimal premium amount and method of receiving the funds.

Please note that not all detailed rules and specifics are included here (there may be rules changes in the future).

You may also be interested in this article (Business Safety Mutual Relief System)

LEAVE A REPLY