(Last updated:2021/1/15)

Overview of Japan subsidy program for sustaining businesses (持続化給付金): English version

-

What is Japan subsidy program for sustaining businesses?

Many Japanese businesses expect declines in revenues because of the coronavirus outbreak (COVID-19), and the Japanese government is going to provide subsidies to struggling companies (up to JPY 2,000,000) and sole proprietors/individual businesses (up to JPY 1,000,000).

-

Who is eligible for the subsidy?

Businesses have to meet the following requirements.

- Businesses’ sales decreased by 50% or more compared with the same month of the previous year, because of the impact of coronavirus.

- Businesses had sales before 2019 and are willing to continue their business.

- For companies, their capital is less than JPY 1 billion. Or, the number of regular employees is 2,000 or less.

Note:

Sales might decline because of other reasons. Then it may not be appropriate to get this subsidy. Therefore, when needed, you will have to prove a clear correlation among the coronavirus outbreak, the decrease in sales in 2020, and the sales in the previous year. There is no need to submit any documents that show sales decreased because of the coronavirus outbreak. But we recommend you prepare something.

There may be an on-site inspection, interview, etc. if necessary.

If businesses received the subsidy illegally, they must return it. And 20% of the subsidy and 3% interest per annum are added. Also, your name will be revealed to the public.

Some businesses such as public corporations are not eligible for the subsidy.

-

By when do businesses have to apply for?

Businesses have to apply for it by 15th January 2021 (starting from 1st May 2020).

*In some cases, it can be extended to 15th February.

-

How can businesses apply for?

Online (https://www.jizokuka-kyufu.jp)

-

How long will it take to get it?

Around two weeks after the application.

-

How much can businesses get?

Here is the formula:

(Total sales revenue in the previous year)-(Sales in the month when a business faced a decrease in sales by 50% or more on a year-on-year, monthly basis)×12

Note:

Businesses are able to choose the month when they faced the decrease (it should be a month between January 2020 and December 2020).

For businesses ending fiscal year on March, if they chose February 2020, the previous year is from April 2018 to March 2019.

For businesses ending fiscal year on December, if they chose February 2020, the previous year is from January 2019 to December 2019.

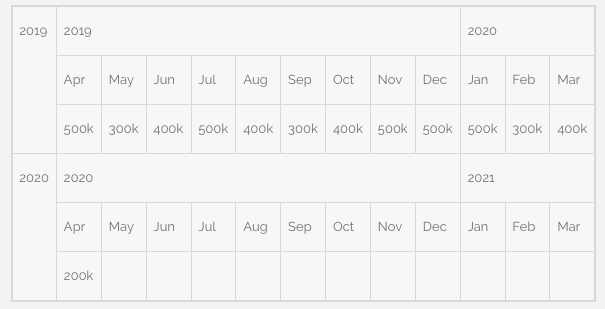

Here is an example (If companies end fiscal year in March).

Total sales revenue in the previous year (from April 2019 to March 2020): JPY 5 million.

Sales in the month when a business faced a decrease in sales by 50% or more on a year-on-year, monthly basis (April 2020): JPY 200,000

Businesses are eligible for the subsidy because 2020 Apr sales decreased by 50% or more compared with 2019 Apr sales.

Formula: JPY 5 million – (JPY 200,000 × 12) = JPY 2.6 million

Subsidy: JPY 2 million (JPY 2.6 million > JPY 2 million)

Here is another example (If companies end fiscal year in December. Or, sole proprietors/individual businesses who filed blue return in 2019).

Total sales revenue in the previous year (from January 2019 to December 2019): JPY 3 million.

Sales in the month when a business faced a decrease in sales by 50% or more on a year-on-year, monthly basis (April 2020): JPY 130,000

Businesses are eligible for the subsidy because 2020 Apr sales decreased by 50% or more compared with 2019 Apr sales.

Formula: JPY 3 million – (JPY 130,000 × 12) = JPY 1.44 million

Subsidy for companies: JPY 1.44 million

(Initially, there was ’rounding down to the nearest hundred thousand yen rule’, and in this case, you only get JPY 1.4 million, but now it is deleted.)

Subsidy for sole proprietors/individual businesses who filed blue return in 2019: JPY 1 million (up to JPY 1 million)

And one more example (sole proprietors/individual businesses who filed white return in 2019)

Total sales revenue in the previous year (from January 2019 to December 2019): JPY 3 million.

Monthly average sales in 2019 (for those who filed white return, they use this instead of choosing a specific month in 2019): JPY 250,000 (JPY 3 million ÷ 12)

Sales in the month when a business faced a decrease in sales by 50% or more on a year-on-year, monthly basis (April 2020): JPY 100,000

Businesses are eligible for the subsidy because 2020 Apr sales decreased by 50% or more compared with 2019 Apr sales.

Formula: JPY 3 million – (JPY 100,000 × 12) = JPY 1.8 million

Subsidy for sole proprietors/individual businesses: JPY 1 million (up to JPY 1 million)

-

What documents do businesses need?

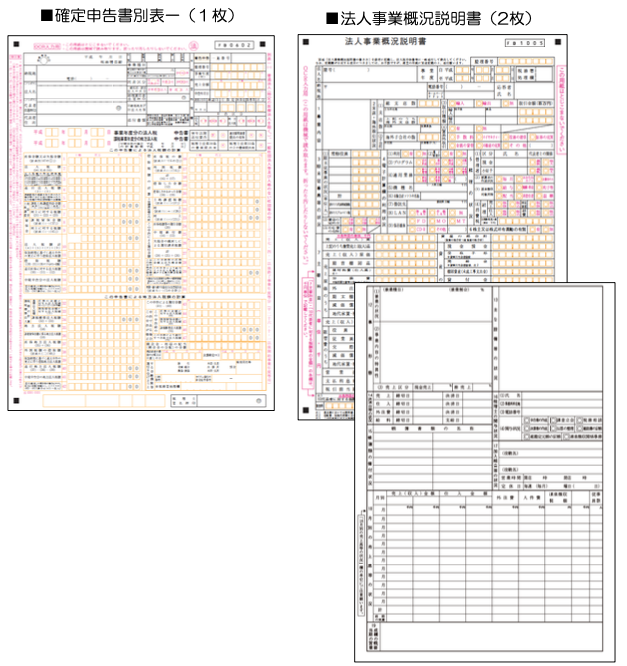

Companies:

- Copy of tax return documents in the previous year: front page of tax return (beppyou 1) and ‘corporation business summary description (Houjinjigyougaikyousetsumeisho)’

Note: Beppyou 1 needs tax office’s stamp (For online tax filing, confirmation email is fine).

- Sales ledger for the month when a business faced a decrease in sales by 50% or more on a year-on-year, monthly basis (This can be created if you use accounting software. Or you can download this. Note: data should be pdf, jpg, or png)

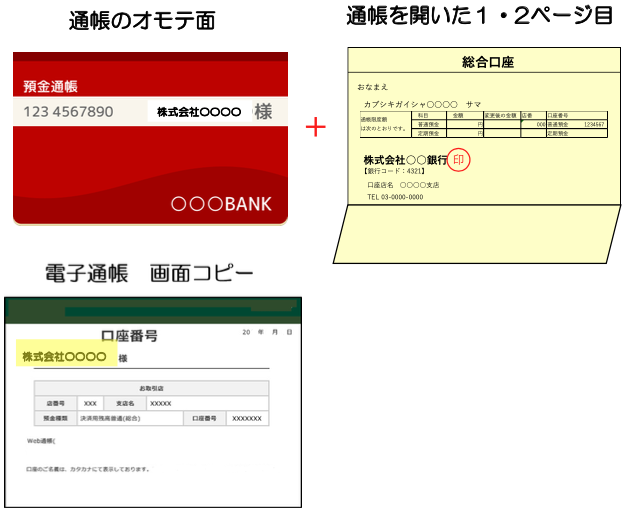

- Copy of bankbook (for companies, bankbook under the name of representative director is fine): it should show bank name, branch number, branch name, bank account type, account number, and account holder name (for online bank, screenshot is fine).

Sole proprietors/individual businesses:

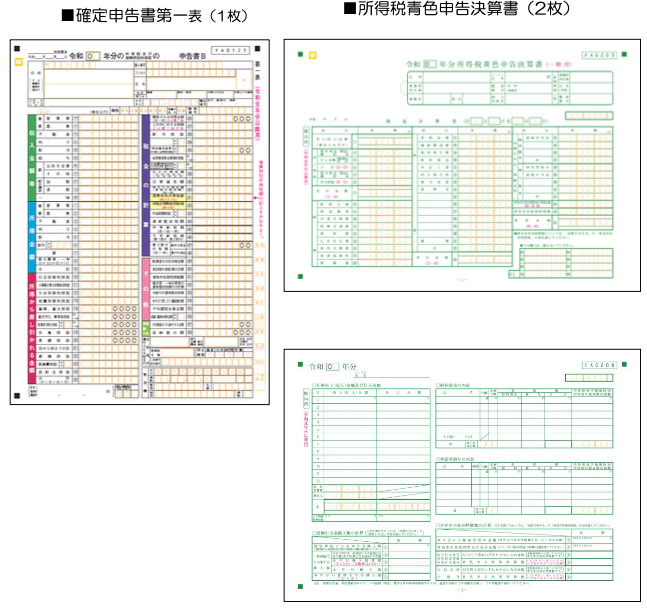

- Copy of tax return documents in 2019: front page of tax return (daiippyou)

- For those who filed blue return: financial statements for blue return in addition to above document.

Note: Daiippyou needs tax office’s stamp (For online tax filing, confirmation email is fine).

- Sales ledger for the month when a business faced a decrease in sales by 50% or more on a year-on-year, monthly basis (This can be created if you use accounting software. Or you can download this. Note: data should be pdf, jpg, or png)

- Copy of bankbook (see above)

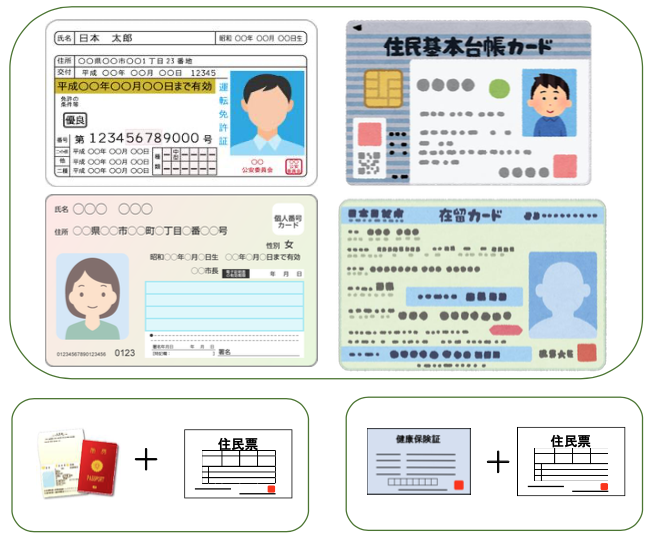

- ID: Driver’s license, My number card, basic resident register card, resident card, special permanent resident certificate, or foreign resident registration card

Note: if you don’t have above ID, you can use a) a copy of certificate of resident and passport or b) a copy of certificate of resident and health insurance card.

-

Special treatments for those who may not be able to get the subsidy.

There are some special treatments for those who cannot apply for this subsidy program because of the reasons such as: I don’t have the required documents for the application, I have not yet completed the tax return in the previous year, monthly sales can greatly change because of the seasonal fluctuations, I have just set up a company in 2019 or 2020, the company merged with other company, the company adopts consolidated tax payment system, etc.

Also, freelance workers (individuals) whose income is employment income (salary) or miscellaneous income under Japan individual income tax law, would be able to apply for the subsidy.

Therefore, it is recommended you ask someone to confirm whether you can apply for it.

-

Subsidy program for rent support (家賃支援給付金)

There is another subsidy program relating to the coronavirus outbreak. Rent expense is one of the biggest expenses for most businesses. They are expected to close their shops etc. to prevent the spread of the coronavirus, but they have to continue paying their rent. And Japanese government will help them through this subsidy. It started on 14th July 2020. For companies, you would receive (up to) JPY 6,000,000. And for individuals, you would get (up to) JPY 3,000,000. Actually, this subsidy is similar to the subsidy program for sustaining businesses (持続化給付金) in terms of the requirements. Therefore, if businesses are eligible for the subsidy program for sustaining businesses, they may be eligible for the subsidy program for rent support as well. However, there are some differences. Please let us tell you.

Key differences:

- Businesses have to choose the month when they faced the 50% sales decrease, but it should be a month between ‘May 2020 (not January 2020)’ and December 2020.

- In addition to the 50% sales rule, businesses are eligible for the subsidy when they faced a decrease in sales by 30% or more for three consecutive months.

- Businesses have to pay for rent (office, restaurant, shop, etc.).

- Businesses need the following documents as additional documents for the application.

- Copy of rental agreement

- Receipts (or other documents showing the payments) for the last three months

- Pledge (https://yachin-shien.go.jp/docs/pdf/format_pledge.pdf): You confirmed your businesses were eligible for the subsidy, you will continue your businesses after your received the subsidy, you understand you return the subsidy when you are not eligible for it, etc.

- How much you can receive? It depends how much you pay for rent per month. But you can expect the amount six times two thirds of the monthly rent. For example, if the monthly rent is JPY 200,000, you would get JPY 800,000 (200,000*2/3*6).

Similar to the subsidy for sustaining businesses, there are some special treatments for businesses that cannot meet the requirements or prepare the documents required. For example, businesses may not have rental agreement, the applicant name differs from the name in the rental agreement, etc. Then they will have to prepare some additional documents.

To apply for the subsidy, you can go to the website (https://yachin-shien.go.jp/index.html).

-

External link

Website for the application for subsidy program for sustaining businesses (no English version).

Website for the application for subsidy program for rent support (no English version).

https://yachin-shien.go.jp/index.html

Japanese government (Japanese)

https://www.meti.go.jp/covid-19/index.html#90

Japanese government (English)

https://www.meti.go.jp/english/covid-19/index.html

(Only limited information is available compared with Japanese website)

-

Caution

The information contained here is for general information purposes only, so you should use it at your own risk. Day One Tax takes no responsibility for any loss or damage caused as a result of the information on this website.

This is a very good guide, however you should add the following:

For people who filed their tax return by post, you will need to go to your local tax office for this 納税証明書.

and ask for it to display your sales income for 2019. This costs 400 Yen.

Thank you for your comments. Sole proprietors/individual businesses who filed it by post and don’t have the duplicate copy need 納税証明書(その2 sono2). You can get it online (https://www.e-tax.nta.go.jp/tetsuzuki/shomei_index.htm).

Thank you.

How do you make the calculation work if [sole proprietors/individual business]:

• You have income in Apr, Jul, Aug 2019, but only have had income in Feb 2020 and no other months?

Thank you for your question. Actually the answer is not officially provided by Japanese government, but the formula would look like ‘JPY 3 million (example) – (JPY 0 × 12) = JPY 3 million (up to 1 million)’. Also, seems your income is not very stable, then it is recommended you consider how your business was (will be) affected by the coronavirus. At first glance, you may meet the requirements easily but if Japanese government says that your business was not very related to the coronavirus outbreak, they may reject your subsidy (Thus many Japanese professionals think the requirements are a bit vague). Please be careful. Just in case.

Is this taxable for the next year?

Thank you for your comment. It is taxable.

Hi guys,

I am just an employee at a restaurant and my boss is receiving this government support.

I heard a lot of employees in my area (except me) keeps getting paid full salary even if they are not working.

Can I complain about this or this government support is not made for employees salary?

Best regards,

Sam

Thank you for your comment. Subsidy program for sustaining business (持続化給付金) and rent support (家賃支援給付金) are not made for employees.